Finland’s NAPA was one of 13 companies that participated in a scenario-based analysis examining three global decarbonisation scenarios to look in precise detail at how the industry – in all its moving parts – might be expected to transition to green fuels over time.

The coalition of contributing companies included Carnival Corporation, Wärtsilä, Meyer Turku shipyard, Aalto University, and the International Chamber of Shipping.

A key outcome was that it is in the industry’s self-interest to act now, despite the uncertainties which are inescapable at present. Outlining such scenarios is considered a good way of stress-testing strategies, guiding towards decisions that are most likely to be robust and attractive.

The scenarios were based on the Shell Energy Transformation scenarios. ‘Storms’ is a scenario where nationalism, geopolitical conflicts, and a worsening climate crisis results in reduced global knowledge exchange and coordination. This results in failure to meet both the Paris climate goals and the IMO 2018 decarbonisation ambitions.

In the ‘Swells’ scenario, businesses and governments concentrate on growth. Decarbonisation advances slowly until the climate crisis intensifies and disrupts shipping and ports. Quick, abrupt change is needed and finally initiated, but is costly. This late action is not enough to reach IMO 2018 ambitions, but eventually, the Paris goals are met.

The ‘Clear Sky’ scenario produces the best outcomes from a decarbonisation perspective as stakeholders worldwide are aligned to common goals. The private sector takes initiative individually and collectively, and policymakers support these efforts. In this scenario, the Paris goals are met, but the IMO 2018 ambitions are not.

In short, the report indicates that shipping is not on track to meet the IMO’s current short-term goals. We are operating in a ‘Swells’ environment and at risk of heading towards ‘Storms’, but by acting now, we can avoid the exponentially rising decarbonisation costs anticipated if action is delayed until it becomes critical. Importantly, taking action now is a non-regret strategy and indispensable for achieving the Paris goals.

The study’s primary suggestion is to tackle decarbonisation comprehensively and collaboratively – calling on regulators, shippers, shipowners, investors, fuel suppliers, ports, and other stakeholders to prevent gaps in the industry-wide effort. A strong focus on green fuel supply chains is needed, as well as other enablers such as Just In Time (JIT) arrival, improved routing, and energy-saving measures such as the adoption of wind-assisted propulsion. Many of these enablers are available today, and there is a need to remain flexible and develop different enablers for different cases and sustained profitability. Investors need to have as much clarity as possible about emissions targets, carbon pricing, and technical and operational requirements.

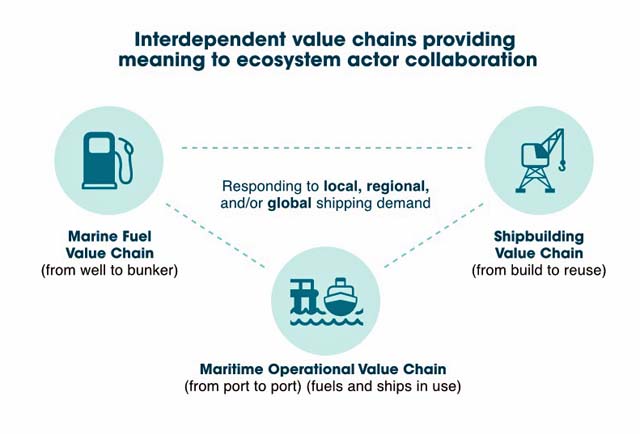

Logically, it is useful to consider three target areas: the marine fuel value chain, the shipbuilding value chain, and the maritime operational value chain. All of these chains are highly interdependent; allowing for the most effective decarbonisation, therefore, means aligning supply and demand across this cluster of chains. The alternative marine fuel supply chain needs to supply enough fuel for ships with alternative fuel engines that are demanded by ship owners / operators / charterers given the demands of each sub-sector.

Cross-value chain coordination should avoid gaps and bottlenecks. For example, we currently have dual-fuel engines but not enough alternative fuel. Initiatives such as the development of zero-emission corridors are a good example of how we can consider value chains holistically and simultaneously from carbon calculation, design, planning, financing, management, and policy-making perspectives to make significant progress. The uptake of alternative fuel is a key enabler that cuts across all three value chains, but many alternative fuels still need to prove their long-term cost competitiveness, particularly because they have a big impact on ship design, engines, tanks, storage, bunkering, and ship operations.

Another key enabler is technology. New and upscaled production technology is needed to produce clean marine fuels, advanced ship engine technology is required to make use of these fuels, and digital technology is needed to support fuel-efficient operations and drive costs and fuel consumption down. This reduces competition for these fuels and the renewable energy needed to produce

To achieve significant decarbonisation, we need a coordinated and concerted effort from across the globe. A fragmented ‘Storms’ world will not succeed. Leading players in the industry need to show what works and what does not so that other public and private stakeholders are better informed.

NAPA is playing a pivotal role in the decarbonization transition, across many value chains, from vessel design to operation and safety, helping stakeholders make the right decisions, using better data to sail smarter and reach the industry’s goals faster. In particular, as part of the Blue Visby consortium, NAPA technology can enable a new contractual framework for maritime voyages, finally tackling the misaligned incentives that drive ‘Rush to Wait’ behaviour.

Many enablers exist now, without waiting for new technology or fuels to scale up. Adopting the Blue Visby solution can reduce emissions among participating vessels by up to 16% just by agreeing to sail at optimised speeds. Designers and operators can use our stability expertise and tools to ensure that safety is a prerequisite for installing any new technology. Any steps taken now will smooth the later route.